Nonprofits work with tight budgets, and every dollar counts. Energy costs keep rising, but most organizations still pay thousands to utility companies. Solar turns this expense into long-term savings that can support your mission.

Key Takeaways:

- Get 30% cash back through federal Direct Pay (available until 2027)

- Cut electricity bills by 70–90% with stable energy costs

- Improve donor appeal by showing strong environmental leadership

- Stay powered during outages with battery backup

Redirect More Funds to Your Mission

Every dollar spent on electricity is money that could support your community. Nonprofits that switch to solar often save 70 to 90 percent on energy costs. For example, one school district now saves over $100,000 a year, money that goes to teachers, supplies, and student programs rather than on electric bills.

Over 25 years, most nonprofits have saved thousands of dollars with solar. Those savings go straight back into your mission.

Direct Pay Makes Solar Easy for Nonprofits

The federal Direct Pay program makes solar affordable for nonprofits. Even if your organization does not pay taxes, you can get 30 percent of your solar installation cost as a cash payment from the IRS. After installation, submit the paperwork, and the IRS sends the payment. No taxes or complicated setup are needed.

This benefit is available through 2027 for churches, schools, hospitals, community centers, and all 501(c) nonprofits, making solar a practical and affordable choice.

Stack Bonus Credits for Maximum Savings

The 30% base credit is just the beginning. You can earn extra bonuses such as additional savings for energy community projects, for using American-made materials, and for serving low-income areas. Combined, these incentives can cover up to 60% of your solar installation costs.

Tampa Bay Solar reviews your project and helps you understand which bonuses apply so you can maximize your savings.

Alternative Path: Third-Party Partnerships

Not every nonprofit wants to own a solar system. With a Power Purchase Agreement (PPA), the solar company installs and owns the system at no upfront cost. You buy the solar power at a rate that’s usually lower than your utility bill.

PPAs last around 15–20 years. The company handles all maintenance and claims the tax credits, passing the savings to you. This is great for nonprofits with tight budgets or those who don’t want to manage equipment.

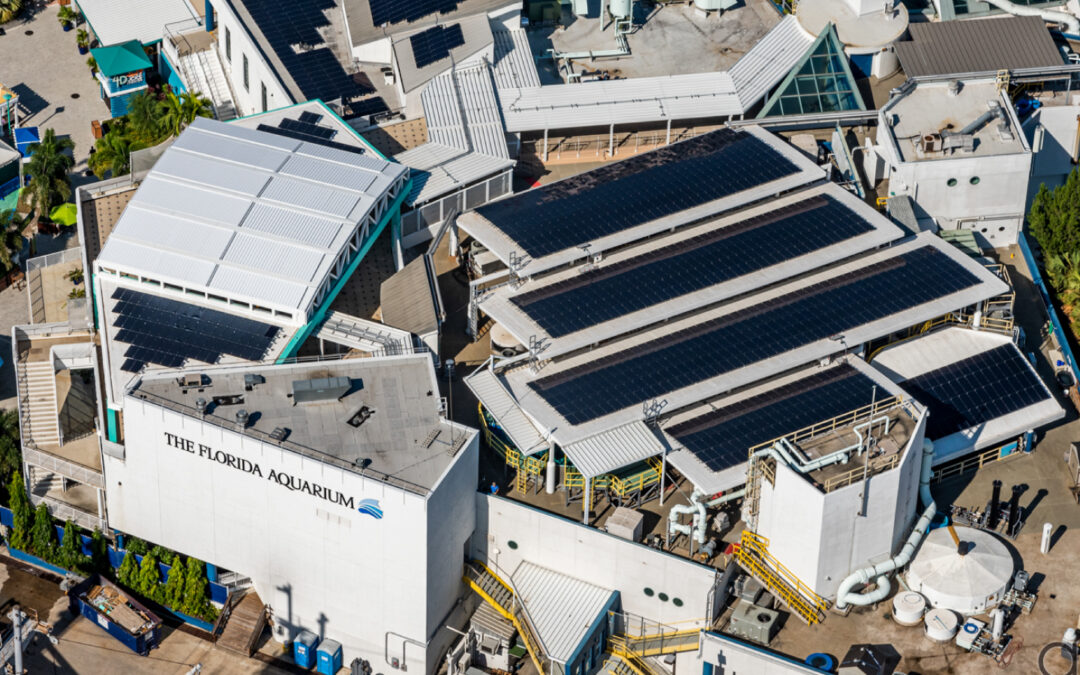

Build Trust Through Environmental Action

Solar panels show donors and supporters that your organization is responsible and forward-thinking. Many foundations now favor organizations with strong environmental practices. Solar energy can strengthen grant applications and appeal to eco-conscious supporters. Installations also serve as teaching tools. Schools can integrate them into STEM programs, churches can highlight environmental care, and community centers can showcase clean energy solutions. The impact goes beyond cost savings.

Maintain Operations During Power Outages

Severe weather can cause power disruptions. Solar systems with battery backup keep your organization running during outages. Medical facilities can preserve medications, community centers can stay open, and schools can protect equipment and maintain security. Batteries also qualify for Direct Pay incentives, giving your organization energy independence and maximizing federal savings.

Lock in Predictable Costs

Utility rates often rise unpredictably. Solar provides fixed energy costs for 25+ years with minimal maintenance. After 5–7 years, your system essentially produces electricity for free. This makes budgeting simple, avoids surprise rate hikes, and gives your organization stable, reliable power for decades.

Simple Steps to Get Started

Getting started with solar is simple:

- Pre-register with the IRS for your registration number

- Install your solar system

- Submit IRS Forms 3468 and 990-T with your tax return

- Receive your payment directly from the IRS

Tampa Bay Solar helps nonprofits at every step. We work with schools, churches, and community organizations to find solar solutions that fit your budget and mission. Save money and support your mission with solar today.

Flexible Financing Solutions

Solar works for every budget. You can purchase outright, use a PPA, or choose financing. Low-interest programs help bridge funding gaps while Direct Pay reimbursements are processed. We help you select the right solution for your organization’s needs and goals.

Act Now for Maximum Benefits

2026 is a smart time for nonprofits to switch to solar. Direct Pay gives you 30% back on your system costs through 2027, making solar more affordable than ever.

Reach out to Tampa Bay Solar for a free consultation. We’ll check your facility, review your energy use, and share a clear proposal with costs, incentives, and savings. Solar lets you save more and support your mission.

Our Service Areas

Hillsborough County: Tampa, Brandon, Riverview, Valrico, Plant City, Apollo Beach, Sun City Center

Pinellas County: St. Petersburg, Clearwater, Largo, Pinellas Park, Dunedin, Tarpon Springs, Seminole

Manatee County: Bradenton, Palmetto, Lakewood Ranch, Ellenton, Holmes Beach

Sarasota County: Sarasota, Venice, North Port, Osprey, Nokomis, Englewood

Pasco County: Wesley Chapel, New Port Richey, Zephyrhills, Dade City, Land O’ Lakes, Hudson