With rising financial uncertainty and a weaker dollar due to recent political changes, saving money is more important than ever. In 2025, the federal solar tax credit will give homeowners a great way to reduce the upfront cost of installing solar panels.

Despite current government shifts, the tax credit is still fully available. This guide will help you understand how it works, who can get it, and how to claim it—making it easier to choose solar and save money when it matters most.

The Basics of the Federal Solar Tax Credit

The Investment Tax Credit (ITC) lets homeowners reduce their federal taxes by 30% of the cost of installing a solar energy system. Unlike deductions, which lower your taxable income, this credit directly lowers the amount of tax you owe.

For example, if your solar system costs $22,000, you can get a $6,600 tax credit. There’s no limit on how much you can spend or claim. The 30% credit is available through 2032, then drops to 26% in 2033 and 22% in 2034. If it’s not extended, the credit will end after 2034.

Who Is Eligible?

To qualify for the ITC in 2025, a few key criteria must be met:

- You must own the system: Only homeowners who purchase their solar systems outright or through financing are eligible.

- The system must be operational in 2025: It must be installed and granted Permission to Operate (PTO) by your utility company in the same calendar year you intend to claim the credit.

- You must owe federal income tax: The credit can only be used to offset your taxes. If your tax liability is lower than your credit, the remaining value rolls over to the following year.

What Costs Can Be Claimed?

The tax credit helps cover many costs of installing solar. Here’s what it does and doesn’t include:

Eligible Expenses:

- Solar panels and associated equipment (inverters, racking, wires)

- Installation labor

- Permits, inspections, and developer fees

- Home batteries that store 3 kWh or more of energy.

- Applicable sales taxes (where exempt)

Non-Eligible Expenses:

- Roof repairs unrelated to the solar system

- Tree trimming or removal

- General home improvements not tied to solar functionality

Additional Incentives That May Apply

The ITC can often be combined with other incentives, depending on your location:

- State and utility rebates

- Net metering credits

- Sales tax and property tax exemptions

- Solar Renewable Energy Certificates (SRECs)

The federal tax credit provides homeowners with a 30% rebate on solar installations made in 2025-unlimited, and anyone can apply for it. It’s a great thing that helps save costs and promotes the use of clean energy.

How to Claim the Solar Tax Credit

When you’re ready to file your taxes, follow these simple steps to claim the solar tax credit:

- Keep your documents: Save all receipts, invoices, and the Permission to Operate (PTO) letter. You don’t need to submit them with your return; keep them if you need proof later.

- Fill out the tax credit form: This form calculates how much credit you qualify for based on the cost of your solar system.

- Add it to your primary tax return: Transfer the credit amount from the form to your main tax filing to lower the amount you owe.

- Ask a tax expert if needed: If you’re unsure about how to file or what happens if your credit is larger than your taxes, a licensed tax professional can guide you.

- Watch the timing: You can only claim the credit in the year your system starts working, not the year it was installed. If it was installed in one year but turned on in the next, you claim the credit for the year it became active.

Tampa Solar Tax Credit Still Available in 2025

Good news! Tampa homeowners can still get a 30% federal tax credit for going solar in 2025. The credit is approved and hasn’t changed.

Florida doesn’t offer a state credit, but in Tampa, you still get:

- 30% off your system through the federal credit

- No sales tax on solar equipment

- No property tax increase for adding solar

It’s a smart time to go solar and save money.

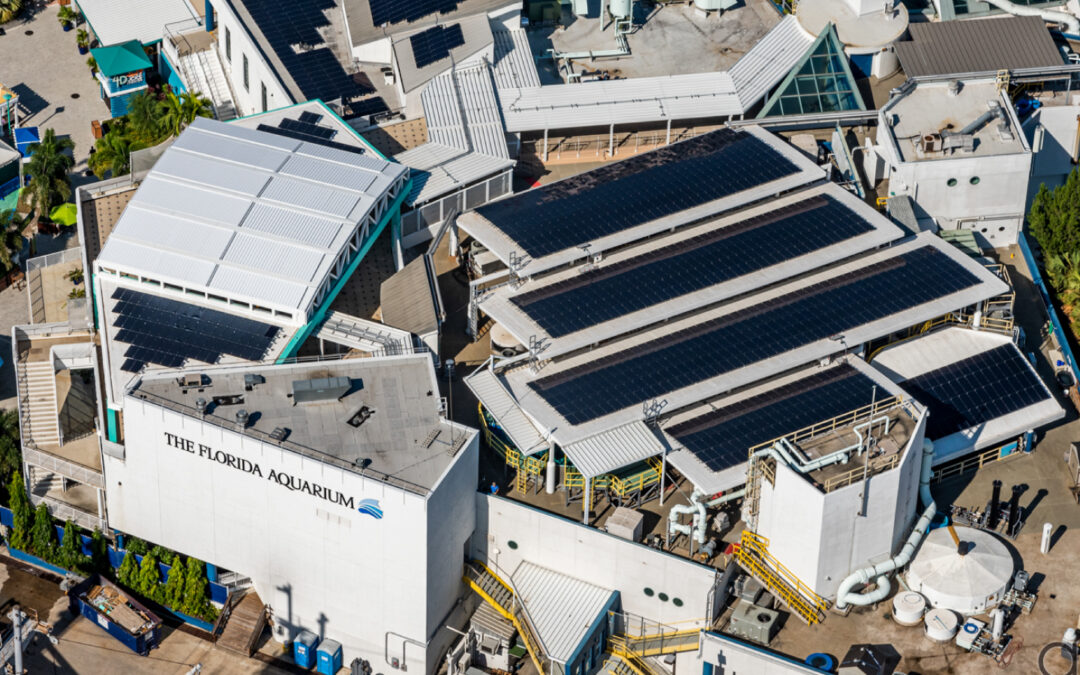

Over the last 20 years, the solar tax credit has helped more people in the U.S. switch to solar energy. According to the Solar Energy Industries Association (SEIA), the solar market has grown by over 200%, lowered installation costs, and made solar power easier for homeowners.

The federal solar tax credit helps homeowners save money on solar systems. In 2025, it still covers 30% of the total cost, with no limit and no income rules. Homeowners can cut costs and gain energy independence by understanding how it works, checking eligibility, and filing correctly.

Our Service Areas

Hillsborough County: Tampa, Brandon, Riverview, Valrico, Plant City, Apollo Beach, Sun City Center

Pinellas County: St. Petersburg, Clearwater, Largo, Pinellas Park, Dunedin, Tarpon Springs, Seminole

Manatee County: Bradenton, Palmetto, Lakewood Ranch, Ellenton, Holmes Beach

Sarasota County: Sarasota, Venice, North Port, Osprey, Nokomis, Englewood

Pasco County: Wesley Chapel, New Port Richey, Zephyrhills, Dade City, Land O’ Lakes, Hudson