Here’s how solar fits can save on energy and support their mission. Starting before July 4, 2026, lets them qualify for the full 30% federal solar tax credit through direct pay. Acting early makes the process easier and allows more savings to be reinvested in programs that matter most.

Key Takeaways

- Start before July 4, 2026, to get the 30% tax credit.

- Early planning avoids permit delays.

- The credit covers solar and battery systems.

- Low-output projects (≤1.5 MW AC) may use the 5% safe harbor; larger projects must start physical construction.

If your nonprofit is considering solar, now is the time to start saving money. Here’s what you need to know: Here’s how to maximize savings and benefits for your mission.

Understanding the July 4, 2026, Deadline

To claim the full 30% tax credit, construction must begin before July 4, 2026. The system does not need to be operational by this date; starting construction is what matters.

Projects that start before the deadline have up to four years to finish. Projects that begin later must be fully operational by December 31, 2027, to qualify.

What the 30% Nonprofit Solar tax credit covers

The federal solar tax credit allows nonprofits to receive a 30% direct payment from the IRS on the total project cost. Eligible expenses include:

- Solar panels and equipment

- Labor for installation

- Permits and inspections

- Battery storage systems

If a nonprofit installs a solar system, it can receive a portion of the cost back through direct pay, freeing up funds for programs and services.

Rules for qualifying projects

- Smaller, low-output solar systems (≤1.5 MW AC) may still qualify using the 5% safe harbor if costs are paid before July 4, 2026.

- Larger projects must begin physical construction, such as site preparation or mount installation, to qualify.

- After December 31, 2025, starting early helps avoid limits on specific foreign-made equipment.

Early action simplifies compliance and increases your chance of securing full benefits.

Step-by-Step process for a nonprofit

- Plan: Discuss your project with a solar contractor experienced in nonprofit installations.

- Site Assessment: Evaluate your property and system design (typically 4–8 weeks).

- Apply for Permits: Permits can take 6–12 weeks; start early.

- Begin Construction: Ensure construction starts before July 4, 2026.

- Complete Installation: You have up to 4 years from the date construction begins.

Starting early reduces stress and ensures smooth eligibility for the tax credit.

Timeline for nonprofit solar installation

Most nonprofit solar projects take 4–8 months from planning to completion. To meet the July 4, 2026, deadline, the nonprofit should start planning as soon as possible, ideally by early 2026.

Why early action benefits your organization

- Locks in the full 30% direct pay tax credit

- Reduces compliance and documentation challenges

- Avoids project delays due to high demand

- Cuts electricity costs sooner

- Frees more funds for programs, staff, and community services

Additional advantages of solar for nonprofits

- Lower monthly utility bills

- Protection from rising electricity rates

- Increased property value

- Funds remain available for your mission

- Recognition for environmental stewardship

Battery storage flexibility

Standalone battery storage systems are not bound by the July 4, 2026, deadline and follow the IRA timeline into the 2030s. This allows nonprofits more flexibility when planning storage-only projects.

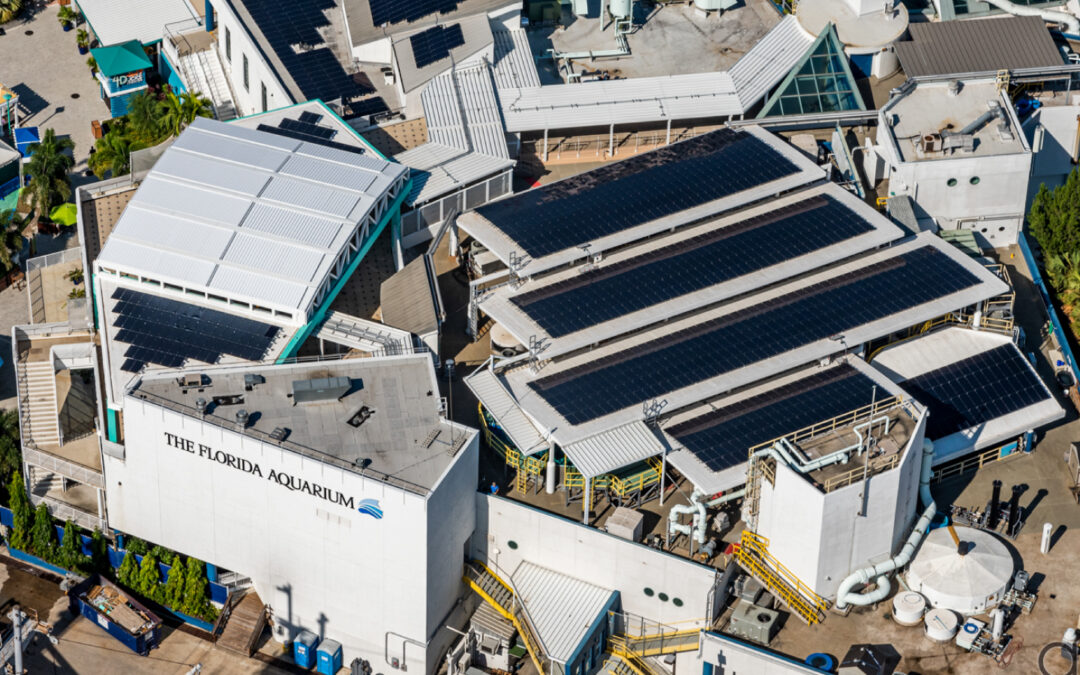

Real-World Example: Schools leading the way

Many educational nonprofits are already benefiting from solar energy. With the help of Tampa Bay Solar, Manatee School for the Arts, operated by nonprofit Renaissance Arts and Education, installed an extensive rooftop solar system expected to cut utility costs by about $900,000 per year. The savings go back into classrooms, student programs, and staff, supporting the school’s mission and sustainability.

Take the first step toward solar

Nonprofits across the U.S. are taking advantage of solar energy to lower costs, improve sustainability, and put savings back into their missions. With Tampa Bay Solar, organizations can begin their solar projects now to help ensure eligibility for the full 30% federal solar tax credit.

Our Service Areas

Hillsborough County: Tampa, Brandon, Riverview, Valrico, Plant City, Apollo Beach, Sun City Center

Pinellas County: St. Petersburg, Clearwater, Largo, Pinellas Park, Dunedin, Tarpon Springs, Seminole

Manatee County: Bradenton, Palmetto, Lakewood Ranch, Ellenton, Holmes Beach

Sarasota County: Sarasota, Venice, North Port, Osprey, Nokomis, Englewood

Pasco County: Wesley Chapel, New Port Richey, Zephyrhills, Dade City, Land O’ Lakes, Hudson