As this post is being written, governments all over the world are imposing lockdowns to mitigate the spread of COVID-19. Six months ago, no one would have predicted a global economic meltdown — yet here we are.

As Coronavirus spreads and the threat of a global recession looms overhead, we know one thing for certain: The only guarantee in life is change, and very few things can prepare you for life’s curveballs. Fortunately, installing solar panels is one of the best things you can do to prepare for unexpected changes down the road – and here’s why.

Remain Operational at a Fraction of the Cost

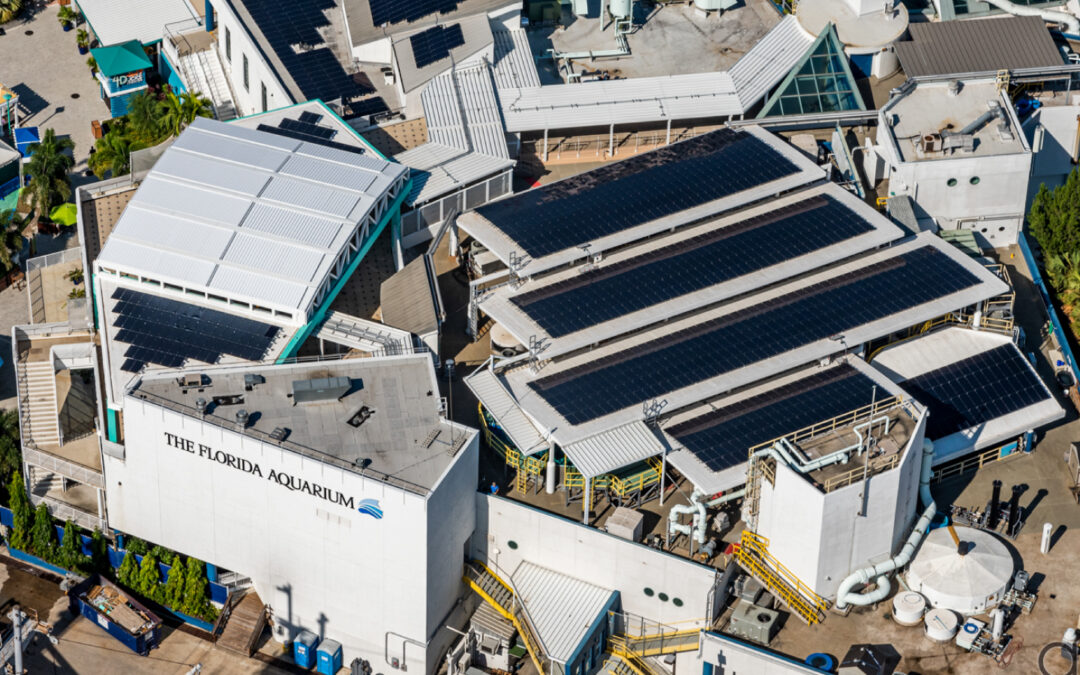

Even after a business temporarily closes its doors, it still needs electricity to operate core systems like air conditioners, refrigerators and computers. For businesses that still rely on traditional energy sources, these fixed electricity costs add up quickly — particularly if there are no incoming sales to offset the costs. This is where solar panels come in: If your commercial building relies on solar panels as its energy source, your energy bill would be one less fixed cost to worry about.

Consider restaurants, for example: Restaurants need to keep their refrigerators operating, or else they risk losing tens of thousands of dollars in perishable inventory. If a restaurant relies on costly electric services but isn’t generating revenue, it won’t take long before it’s in the red; if they rely on solar power, however, they can keep refrigerators operating at a fraction of the cost, even without steady income.

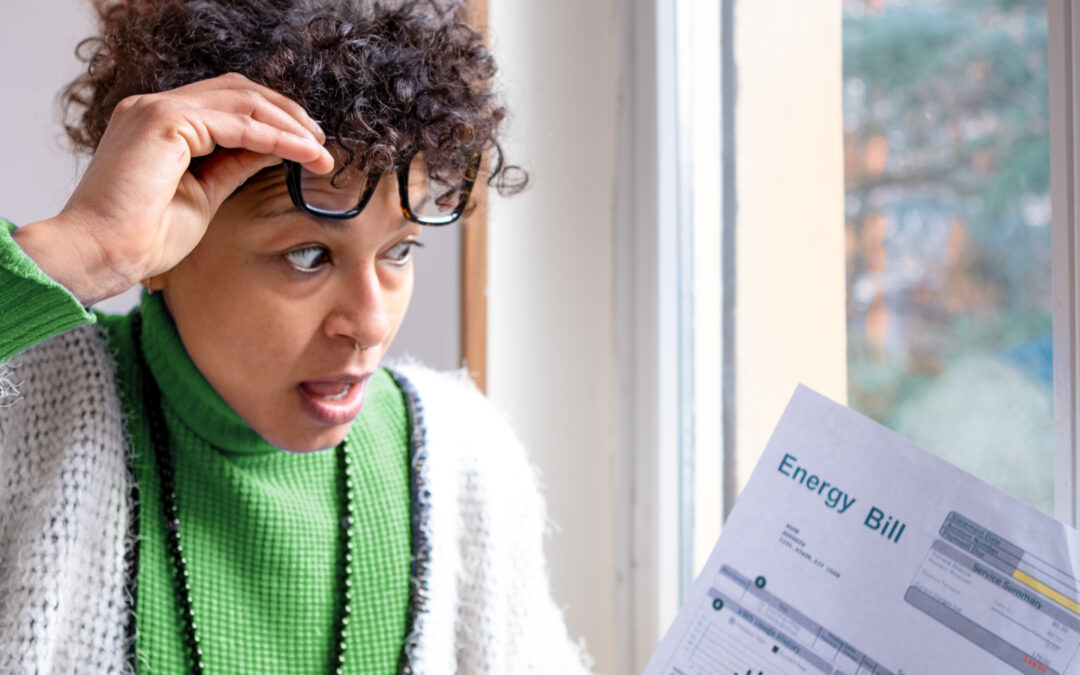

Here’s the bottom line: While it’s difficult to predict how much electric company prices will rise over the next five years, we can predict the price of a solar array today down to the penny. In this way, solar is a great hedge against inflation, and the ROI (dollar-over-dollar) on most systems is between 10% and 14%. Plus, most commercial solar arrays pay for themselves in five years, with only a slightly longer ROI for residential systems. For this reason alone, we hear plenty of customers say, “I wish I had invested in solar panels sooner.”

Solar Panels + Tampa Sunshine = A Powerful Duo

Predicting sunshine is a lot easier than predicting the stock market. And considering that Tampa Bay gets an average of 290 sunny days per year, which is over 80% of the year, it’s easy to argue that investing in solar panels is a safe bet – especially since the sun still produces energy even on the cloudiest days.

Plus, if you put $15,000 into a solar array on your home or business, the energy output is actually tax-free income. In addition to generating tax-free income, adding solar panels can do wonders for the value of your home or commercial building: According to a study from Zillow.com, homes with rooftop solar panels sell for 4% higher market value.

Solar Panels Go Hand-in-Hand with Rising Electric Vehicle Demand

As consumers buy more plug-in electric vehicles, demand for electricity will continue to rise – and so will electric company prices per kilowatt. If you buy solar panels now, you will not only get a large tax credit back from the federal government, but you will also know – down to the penny – how much your electricity will cost over the lifetime of your solar panels, which is usually 30 to 40 years.

This is an important consideration because, as millions more consumers start driving electric cars, solar-powered homes will become more desirable. Electric car drivers already have to spend an extra $30 to $50 per month on electricity to charge their vehicle, so a home with a $250 monthly electric bill won’t be nearly as appealing as a home with affordable solar power.

This appeal applies to commercial buildings, too: When our company installs a commercial solar array, we typically include several electric car chargers, which makes that business more attractive to high-income clients that drive electric vehicles like Teslas, Porsches or Audis. Plus, if the business owner and employees have electric vehicles, having the luxury of charging their cars at work is a great add-on value.

Solar Panels are Economical Alternatives

One way to look at the cost of solar is to divide it out over the life of the solar panel system: Take the cost of your solar array, subtract the tax credit, then divide that number by 30 years.

Example: A $15,000 solar array minus a 26% tax credit ($3,900) = $11,100

$11,100 (the dead cost of the system) divided by 30 = $370 per year

If you’re like most energy consumers, you’re probably paying far more than $370 per year to TECO, Duke, FPL or WREC. In fact, some business owners pay $370 per month alone!

Of course, the cost of your solar array depends on the energy requirements for your home or business; it might be larger than $15,000, or it might be smaller.

For example, one of our team members, Ben A., has a large solar array on his home that has generated $200 per month in electricity pretty consistently over the past few years. It even generated power during the 2008 stock market crash, during Hurricane Irma, and most recently, during the Coronavirus outbreak.

As we go into this recession, folks like Ben are spending less than $50 per month in combined gasoline and electric charges for both their Chevy Volt and home. Compare this to four years ago – when he was spending over $400 per month on combined gasoline and home electric costs – and the benefits of transitioning to solar power are a no-brainer.

For commercial systems, you can also rapidly depreciate the cost of the system minus the tax credit. But rest assured, when we prepare a proposal for your business, we will parse those numbers for you in a detailed analysis.

Life can be unpredictable, but your energy consumption doesn’t have to be. With the right investment in solar power, you can insulate your budget from the wild price fluctuations commonly associated with non-renewable energy services. Contact us today to get a customized proposal, learn about your solar power options, and take back control over your energy costs.