During market downturns, homeowners with money in mutual funds have a couple of different options: One option is to sell and move that money into treasury bills or municipal bonds, with a 1% return. Another option is to keep their money in a poor-performing mutual fund and hopes it regains value in 3 or 4 years once the market bounces back.

Or, there’s a better option: Investing in something that gives you tax-free income. Investing in something that increases the resale value of your home. Investing in solar panels.

Why Are Solar Panels a More Cost-Effective Option?

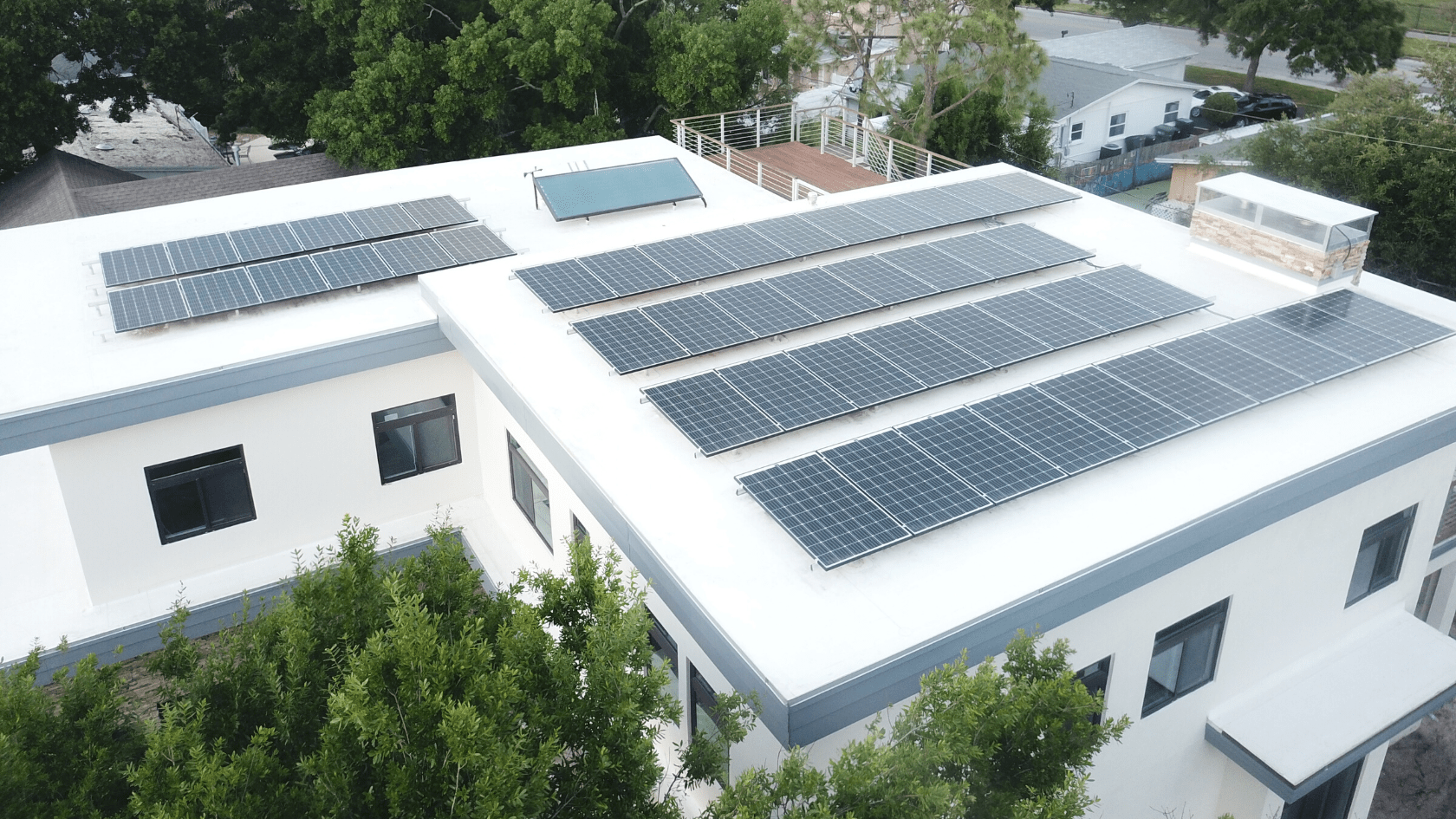

Let’s say Tampa Bay Solar installs a $20,000 solar panel array on your roof that generates $200 per month in electricity. Considering that these panels last 30 to 40 years, at a minimum, you are looking at generating $72,000 in energy over the next 30 years that is NOT taxed as income!

Investing $20,000 to get $72,000 in tax-free income is not bad — especially considering that $72,000 in energy is based on 2020 prices per kilowatt, so as prices go up over the next 30 years, the dollar-for-dollar output of your solar will increase, too.

Plus, the energy output from your solar roof panels is completely insulated from stock market crashes, viral pandemics, wars, political scandals, etc. As long as the sun comes up in the morning, your rooftop investment is safe — and because the solar panels are rated to 150 mile-per-hour winds, your solar panel array can even tolerate a hurricane!

Another benefit of solar panels? If you own a plug-in electric vehicle, rooftop solar panels also insulate your wallet from rising gas prices. While gasoline prices are still low today, there will be a more global demand for fossil fuels as the global economy grows over the next 5 years. Fueling your car and your home from sunshine will cost far less than any other alternative.

Several Tampa Bay Solar employees have rooftop solar panels and drive electric cars. In looking at their real energy costs over the last two years, we’ve seen an average savings of $300 to $400 per month (per household) because they no longer pay for gasoline and only pay a $15 connection fee to the electric company.

Rooftop solar + electric vehicles = smart money.

Make an Investment with Tampa’s Trusted Solar Company

Another advantage that solar panels have over a mutual fund is the intangible nature of equities versus the tangible nature of your solar panel array. Your $20,000 sitting in a mutual fund is only a number in a computer database; the solar panels on your roof are part of a physical system that you can touch and feel.

All solar panel arrays use inverters, and all inverters upload production data to the internet, so our solar clients can look at the energy production on their roof in real-time. These monitoring systems are included in the price of the array — there is no monthly fee for this service. When you own a solar panel array, you can look at your present energy production as well as historical data, and many of our clients love this feature.

So, what if you have no extra money to invest, but you still have a $200 per month electric bill? Experts at Tampa Bay Solar can show you how to finance a system so that your $200 goes toward paying off your solar panels, instead of going to the electric company as an endless rent payment.

After all, paying $200 per month to TECO, Duke or FPL is just like throwing that money into a burning fire pit every single month — you get no return on that money. Fill out Tampa Bay Solar’s contact form today, and our team will call you to discuss your options over the phone. Request your free energy audit, and Tampa Bay Solar will show you why solar panels are the best investment you can make to lower your costs and generate your own energy.